Marc-Antoine Collard

Chief Economist – Director of macroeconomic research

Baring the Great Financial Crisis and the first year of the Covid pandemic, global growth in 2023 could be the weakest in 30 years amid fading reopening tailwinds, ebbing workers purchasing power, monetary tightening and energy rationing. However, investors remain hopeful of a not-so-hard economic landing thanks to an eventual return to a low and stable inflation environment.

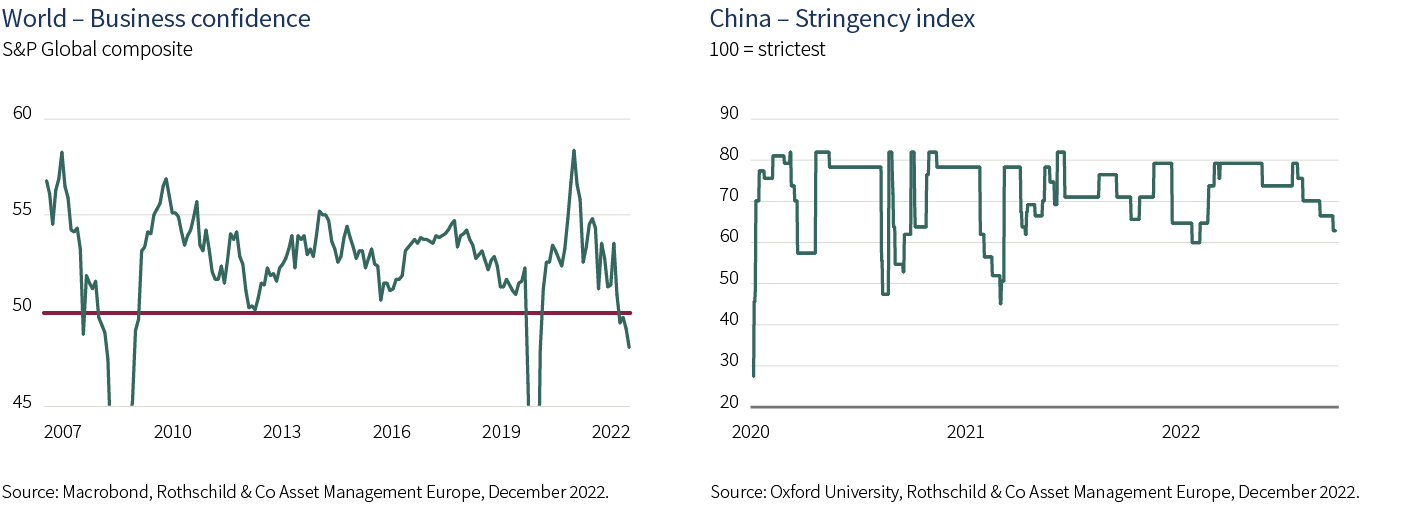

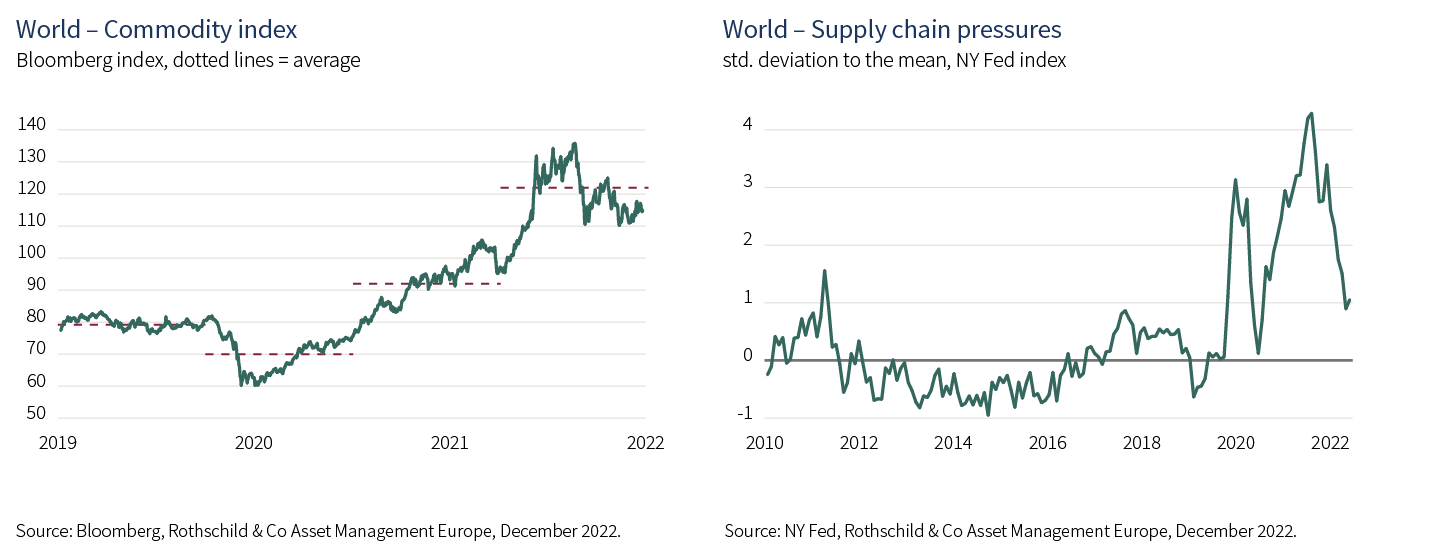

The latest NBS business confidence survey suggests China’s economic activity contracted further in November amid a record Covid outbreak. The non-manufacturing PMI, which measures activity in the construction and services sectors, unexpectedly declined to 46.7 from 48.7 in October, while the manufacturing PMI fell to 48, the lowest reading since April(1). The sub-index measuring suppliers’ delivery times worsened further in November, a sign of supply disruptions with possible repercussions for the global inflation outlook. What’s more, according to a survey by China Beige Book International, about 53% of Chinese firms reported Covid cases in their workforce in November, the highest level since January last year. That said, an easing in the zero-Covid policy is taking effect as the authorities aim to limit the economic damage and to respond to the recent public appeals, which will however add to the risk of overwhelming the health care system. The November S&P Global world manufacturing business confidence index fell again to 48.8, pointing to an intensification of the downturn as the output sub-index (47.8) fell to a new low since June 2020 and a level rarely seen outside of recessions. There was some positive news on the price front, however, as price pressures continued to ease. More broadly, global inflation is on track to slow markedly, aided by fading bottlenecks in global supply chains and commodity price shocks.

According to the flash estimate, Eurozone inflation fell for the first time in more than one year, down to 10% in November from 10.6% in October(2). Although a month does not make a trend, the prospect of weakening price pressures will bring relief to the ECB after data repeatedly exceeded economist forecasts. That said, underlying pressures remain strong with core inflation unchanged at a record high of 5%(2). As the passthrough from commodity energy costs to households’ energy bills remains highly uncertain, the Governing Council is likely to remain concerned that persistently high inflation could de-anchor inflation expectations, yet the rate hike in December might downshift to 50bps. In the US, the October CPI data were not particularly soft by pre-pandemic standards, with the headline up 0.4% m/m and the core index up 0.3%(3). However, they did come out below expectations and details of the report gave credence to the idea that the long-anticipated inflation downshift is starting to take shape. Recent data is likely to keep the Fed on track to hike rates 50 basis points (bp) in December, slowing the pace of tightening from the 75bp cadence seen in the last four meetings.

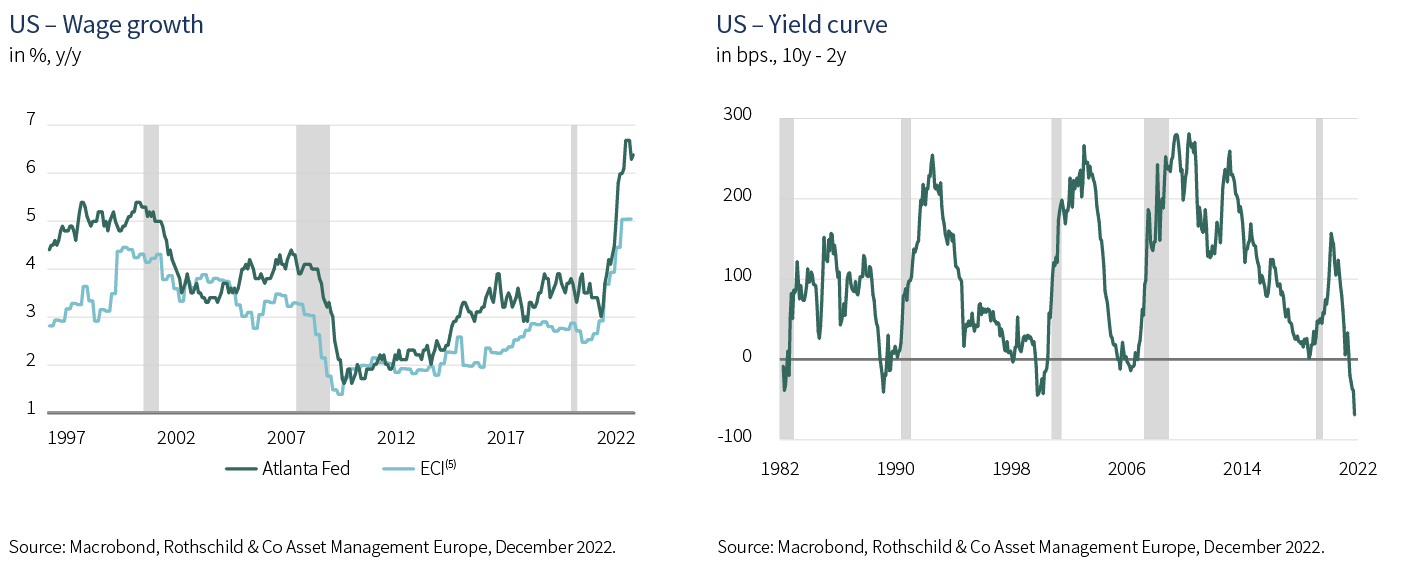

While global inflation has likely passed its peak, price pressures have become more broad-based. With households and businesses tending to form their expectations at least partly based on recent experience, it is not surprising that near-term survey measures of inflation expectations have risen, although market-based indicators of longer-term inflation expectations generally remain well-anchored. Incidentally, a key measure of the extent to which above-target inflation is becoming entrenched is the pace of unit labour cost growth. The latter is now rising in most economies, reflecting the combination of stronger wage increases and weaker labour productivity growth. Although the pace of employment growth has slowed recently in some countries, with vacancy rates beginning to ease, labour markets generally remain tight. Investors anticipate that the sharp economic slowdown in 2023 is unlikely to produce a large rise in unemployment as job losses may be more limited than would be expected on the basis of past downturns as businesses wish to retain workers that have been hard to recruit after the pandemic. Accordingly, even though inflation will fall, it is nonetheless expected to remain well above target over at least the next year, and as such wage demands in 2023-24 will face upward pressures.

The Eurozone unemployment rate fell to a new historical low of 6.5% in October despite a slowing economy. Wage pressures seem to be contained, so far, but is accelerating according to a new wage tracker based on real-time data from a collaboration between the Central Bank of Ireland and Indeed, the worldwide job search website. In the US, a larger-than-expected 263,000 jobs were added in November, which was little changed from the prior three months’ 282,000 average monthly gain(4). The unemployment rate held steady at a low 3.7%, but for the third consecutive month the participation rate ticked down, landing at a mere 62.1%(4). These data figures suggest that the US labour market remains very tight amid strong demand and weak supply, and perhaps more alarming from the Fed’s perspective was the 0.6% m/m gain in average hourly earnings(4). In fact, most measures of employees’ compensation remain incompatible with inflation returning to target. Accordingly, it comes as no surprise that in his latest speech, Fed Chair Jerome Powell insisted that more rate hikes are needed and that restoring price stability would likely require holding policy at a restrictive level for some time. While neutral rates – a real interest rate at which the policy stance is neither accommodative nor restrictive – are a long-run concept, unobserved, difficult to estimate and may vary over time, investors seem to ignore the warning and expect the Fed to cut rates as soon as Q3 2023. The sooner the Fed can slow the pace of tightening and the shallower the path of overall tightening ends up, the more likely it is that the Fed can achieve its desired soft landing. Still, lags in the policy transmission mechanism suggest that the maximum drag from monetary tightening still lies on the horizon. In that regard, the prolonged inversion of the yield curve and the falling of the Conference Board’s leading economic indicator – both having proved in the past to be a reliable indicator of a recession – are worth monitoring.

Completed writting on 6 December 2022